Disclosure and the “about” sections are really important place more reliance on the opinions of people who have relevant backgrounds and real expertise.

It’s really, really important to know what someone’s background and experience is - and what their bias, motivation, and potential conflicts are - and take that into consideration. Those calculators and sites get updated regularly, too.There are a ton of popular investing, finance and retirement blogs and websites (and podcasts) available many of which are very worth reading and listening to, and often have the most up-to-date information.One issue is that unless those sites are associated with a particular broker - and so subject to rules which prevent them from talking crap or being misleading and failing to disclose material risk, and/or not clear that what they are saying may not be the right thing or not suitable for you - they’re not always reliable. Because no one wants you to STOP investing for retirement. Everytime I read one of these books, I get at least a few new helpful takeaways, but any book that covers performance and “reasonable expectations” goes stale, quickly.I’ve also put my savings and retirement planning through at least 10 different financial companies’ planners and calculators and despite the same facts and expectations, I’ve come up with conclusions telling me that I am “on track” (yes!) to “deep in the red” (yikes!) to feeling pretty damn confident and considering buying myself a new high-end Tesla! (Yabba dabba doo!).And when I change my plans due to unforeseen events, like changing jobs or other dramas, I have to go through all ten again, until I find one that doesn’t make me panic.

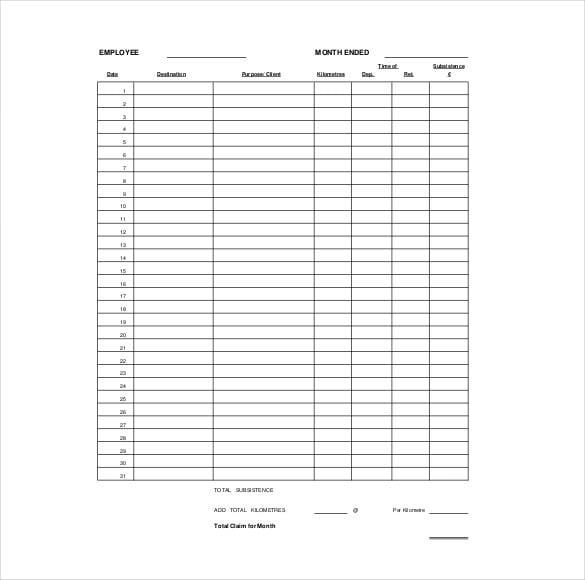

Free household budget worksheet pdf how to#

They have a stake in making sure that they tell you what you should know about investing and investments* - it’s just that it’s not always specific to you, and not as comprehensive as you might like.You are absolutely right that in order to get a sense of how to plan ahead, you need to read and understand the equivalent of at least one long book. (from 2013 but still covers the “big” ones): Top 10 Personal Finance Books of All Time here’s a good list from The Balance: The 9 Best Personal Finance Books to Buy in 2019 (including this, AgeProof ) and here’s a final list from NerdWallet: 7 Personal Finance Books for Your 2018 Must-Read List - NerdWallet There’s some overlap.I read, or skim, at least a few money books every year, and they’re all usually pretty good on the basics of financial literacy and retirement planning - though I’ve yet to find something that’s really “great.” And in terms of what you’re looking for, almost none are that detailed - they can’t be! For one thing, the “rules”, as they relate to Social Security and Medicare, keep changing.There is plenty of well-written good information available on how to have healthy finances, especially on for-profit financial services organization websites (banks, brokers, etc.) - in fact, that’s some of the best information out there. But a lot of books and money gurus are like that: Robert Kawasaki runs extremely profitable workshops Suze Orman backed and sold, through affiliates, pre-paid debit cards, long-term disability insurance, and DIY legal documents.Here’s a list of of top finance books from Inc. I was disappointed by Tony Robbins’ book “Money Master the Game” - when push came to shove, it was a long ad for investing in Robbins’ client Ray Dalio’s funds - a “special offer” for readers.

Almost all say the same thing live frugally, develop avenues of passive income, pay off debt, have an emergency fund, buy more of my books, worksheets, and programs.I’ve read a ton of money books. Or get you to buy real estate instead of going into the securities markets or tell you to buy insurance.

Look to websites, government and nonprofits, and financial literacy programs at community colleges and community centers or to qualified and communicative financial planners to keep you up-to-date and knowledgeable.Just like your physical health, your financial health is complex and unique-to-you.I don’t believe there is any one excellent book that focuses on issues related to retirement finances - for one thing, most people with money books are trying to sell you something. TL DR Pretty much any popular personal finance book will help you better manage or understand your finances (but for the scammy ones) but almost none will give you the scoop on changing programs like Social Security and Medicare supplements.

0 kommentar(er)

0 kommentar(er)